Why Debenhams Flopped: A Retail Fashion Audit

If the current trend continues, we’d have seen 63 medium or large retail companies go bust by the end of this year.

A Retail Fashion Audit: Why Debenhams Flopped

By Luke Frake

Introduction

If the current trend continues, we’d have seen 63 medium or large retail companies go bust by the end of this year. This is higher than losses seen in any previous year. If this continues, expected impact for job losses alone will reach almost 100,000. That’s a pretty scary statistic - and a lot of people out of work. The latest company to fall short of expectations is Debenhams. So what we wanted to investigate was, what is stopping these mammoth companies (many established in the 1800’s) from continued, wild success? Why are the new retailers - the digital age retailers - the likes of Amazon, ASOS, Misguided and Pretty Little Thing, having such great success in comparison? We analysed the User Experience of the Debenhams website, to understand what’s truly been holding it back.

Let’s Look at the Customer

Customers have more and more choice when purchasing online as time goes on. Brand loyalty is dying fast, and people want convenience first and foremost. In no sector is that more true than in retail. If a customer can have an easier experience purchasing the same item from another location, they will. Remember, ease includes search, simplicity in finding detailed information, speed, and the transactional process as well.

If we start focusing on the most important person, the end customer, it becomes more obvious to pinpoint what exactly holds brands back from achieving online success. It’s themselves. Companies like Debenhams and those that have failed before them, have made bad decisions, probably based on bad advice, which has cost them from making a successful splash online.

Delivery

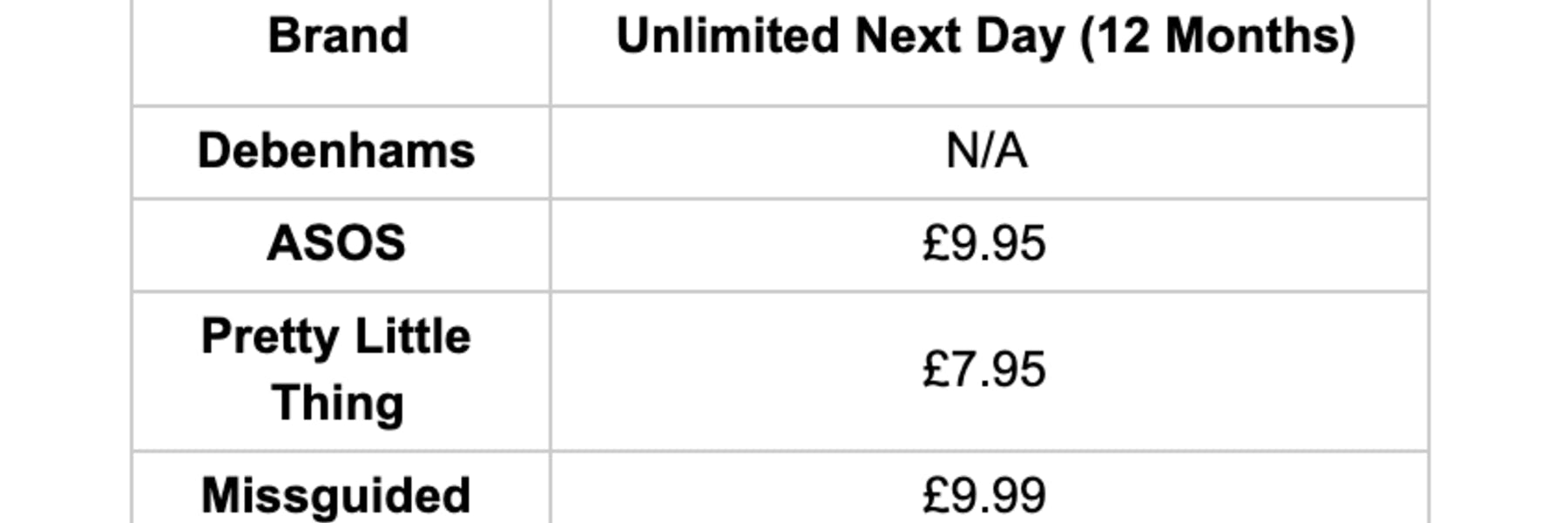

How cheaply and quickly you can receive your product is fundamental when allowing people to shop online. Let's look at a breakdown across some of these well known brands.

When looking at this delivery comparison, Debenhams prices look fairly reasonable in comparison to our other brands. ASOS is the only brand beating Debenhams on it’s free delivery option and base price. In addition, ASOS and Missguided have added another band, depending on where in the UK you live, offering same day delivery in specific locations costing between £2.95 - £9.95.

The one area in which these brands are beating Debenhams hands down, is their offering of a delivery subscription. Although customers aren’t excited about brand loyalty, they do like ease of use. Having a subscription service allows you to have a cost loyalty, meaning that customers are more likely to do more shopping with you, a solution first made popular with Amazon Prime. The cost of these subscriptions are very reasonable, being not much more than standard delivery, and they allow for this new stream of customer acquisition.

Payment Options

How effortless it is to support payments is also vitally important. Looking across our brands (Debenhams, ASOS, PLT, Missguided) all of them have the standard options: credit, debit and gift cards. Debenhams offers its store card as well, which works in a similar way to a credit card.

ASOS, Pretty Little Thing and Missguided all offer PayPal as a differential to Debenhams. PayPal allows users to purchase just by remembering a username and password, rather than their full card number and associated card details. This allows for an easier and more streamlined purchasing method for customers, by taking the thought process and a level of difficulty out of purchasing. PayPal also offers its own credit options, and is fully insured for any purchase, so this doubles up as a more valuable finance solution for customers.

ASOS, again, goes one step further and offers Klarna. Klarna allows for quick and simple payment, or the option to finance your purchase in two ways. Sliced over a period of time, and buy now, pay later. This, again, really simplifies the purchasing journey for the ASOS customers and removes payment as a barrier to purchase.

Image Quality

A consistent theme on the Debenhams website is images being shown at a higher resolution than their actual size. This leads to poor quality and blurry imagery.

Actual vs On the Website

These small visual inconsistencies are enough to begin to make the brand feel cheaper in comparison to its competitors. Especially up against ASOS, Pretty Little Thing and Missguided, (who clearly spend a large amount of time getting their imagery spot on) this is not an impact to User Experience that any fashion retailer can afford.

Influencers

The new way of marketing products through user generated content (UGC) is changing the way that brands sell and grow. This is an area in which Debenhams is really lagging behind our other three comparison brands.

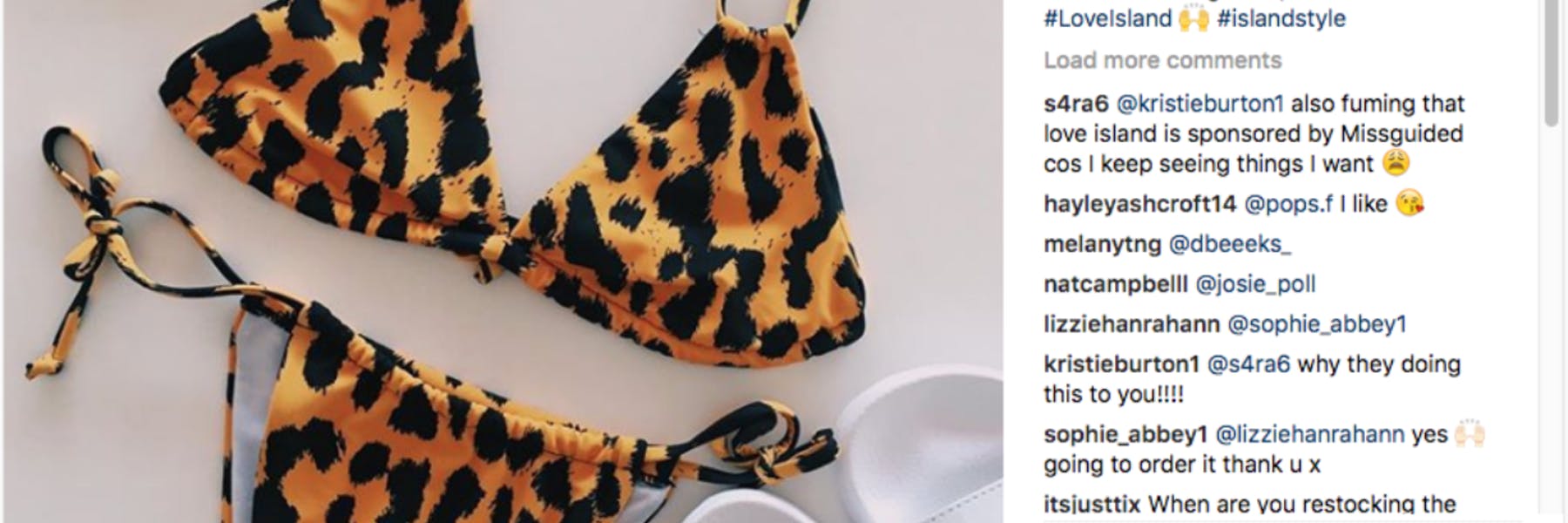

Missguided for instance, sponsored the last season of Love Island. Missguided supplied the contestants with their own wardrobe of branded clothes. As part of this, they further pushed the message by allowing customers to purchase the clothing the stars had on in the show. This really capitalised on their investment by tapping into each reality stars social following, and linking posts back to the products they were selling.

ASOS too, have launched their own range of influencers, known as the “ASOS insiders”. They’re a group of 20-somethings who have their own specific tastes, and combine ASOS clothes together to create new looks.

Using influencers is a growing trend that some of these classic brands don’t seem comfortable in getting involved with. There are more and more specific influencers popping up every day - from clothing to cleaning. Essentially, there is a vital disconnect from the target audience, and understanding and delivering the methods of marketing that work for that demographic. In the case of fashion retailers - influencer marketing is one stream that can not afford to be ignored.

Conclusion

For this article, we have conducted User Experience testing for four different brands. These brands are all recognisable, big brand fashion retailers experiencing varying degrees of success. By dissecting the common offerings, we were able to pinpoint areas of each that supported - or hindered the overall user experience.

Some of the key areas we uncovered through our audits on these retailers sites were customer focus, methods and costs of delivery options, support of different payment options, product image quality, and use of influencers in their marketing strategy.

The old school retailers like Debenhams have been getting left behind in these modern user experience times. There has been plenty of speculation as to why this has been happening, but now we can pinpoint the areas for improvement that could have turned things around for them if they had been addressed prior to dissolving. Their slow struggle in attracting and converting new customers was no mistake, but was written in the UX design of their website.

About the Author

Luke Frake is a CRO Specialist, Keynote Speaker and Client Services Director at Space Between.

Follow Luke on Twitter @LukeFrake